Credit Scores 101: Achieving and Maintaining a Good to Great Credit Score

As a real estate agent, investor, and mortgage broker, I have seen quite a few credit reports. It doesn’t matter if my client is looking to buy, sell, refinance, or rent… a credit check is necessary across the board. And when it comes to proceeding with a client, their credit score could be a dealbreaker.

I remember getting my first credit card like it was yesterday. Like most millennials, I did not take the time to read a handbook on the ins and outs of maintaining a good credit score, but I understood the value of using my credit responsibly. It wasn’t until I became interested in financial development and real estate that I deep-dived into credit scores and basically learned enough to write my own handbook.

At its core, a credit score is a three-digit number that represents your creditworthiness and potential credit risk. The better and higher your credit score, the more likely you will be approved for higher lines of credit, lower interest rates, and additional investments. Alternatively, the lower your credit score, the less likely you are to keep your credit card or be approved for a loan, and the more likely you are to receive higher interest rates.

Some benefits of holding a good credit score include:

Higher approval rate for credit cards

Higher loan approval

Lower interest rates on lines of credit and loans

Higher credit limit approval

Higher approval rate for renting

Useful for cell phone contracts, car insurance rates, and avoiding utility security deposits

So, what makes a credit score good? What makes it bad? Let’s start with the basics.

What’s a Good Credit Score?

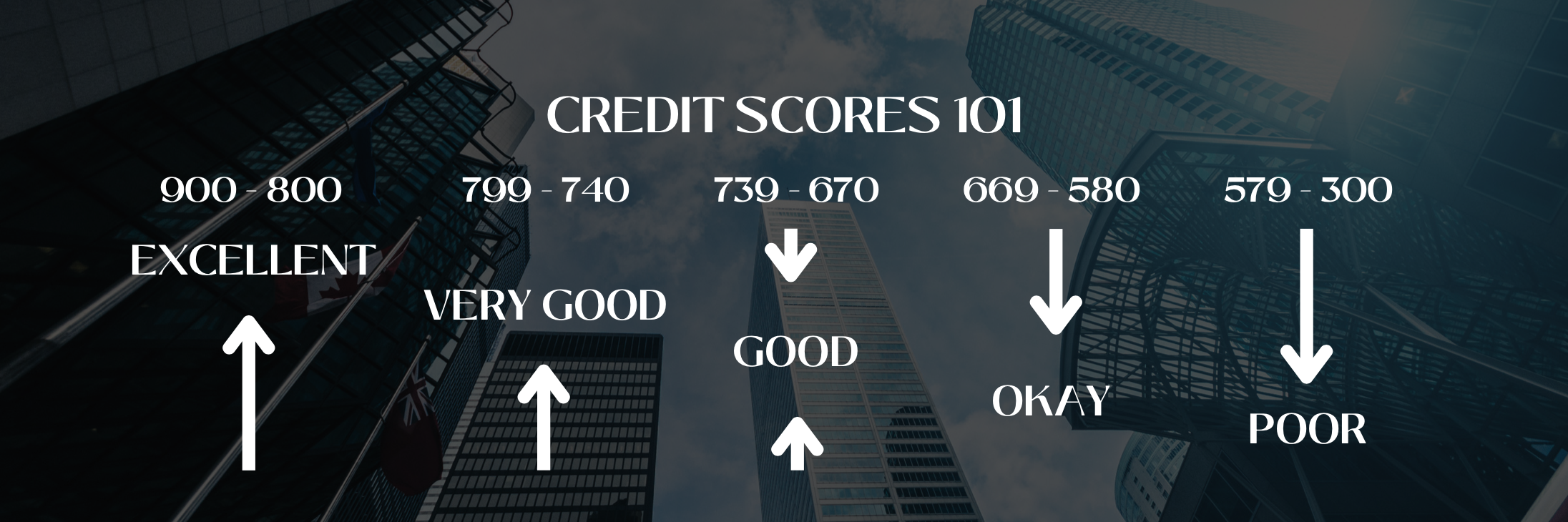

Credit scores range from 900-300, with 900 being the highest. An excellent credit score will fall anywhere between 740 to 900, while anything below 580 to 300 may be considered a poor credit score.

With a score of 850-900, borrowers will have missed little to no payments and likely regularly pay their monthly credit balances on time and in full. These higher scores result in fast approvals for high loan and credit limits, plus the lowest available interest rates. In addition, with a consistently high credit score, you may receive access to premium cards and credit benefits that higher-risk users cannot access.

Achieving and maintaining a high credit score accounts for several factors that affect a borrower’s score month by month, transaction by transaction. Listed below are four things that affect your credit score.

What Affects Your Credit Score?

1. Your Starting Point

When I got my first credit card, it was because my parents felt confident in my level of financial literacy and thought it was time for me to begin building a line of credit. They understood that the longer an individual’s credit history is, the more information there is to exemplify their creditworthiness or their credit riskiness. Getting a credit card allows a borrower to begin building a history of financial stability, which carries them forward through their most significant financial transactions. Starting a line of credit sooner rather than later can create a stronger storyline that positively affects your credit score.

But remember – lender’s like to see consistency and diversity in your history. For example, your record will reflect instability if you have a long line of credit, but irregular use patterns. Additionally, using your credit card for various transactions can produce a diverse credit history, which can help your lender better understand your spending habits. Using your credit card on a regular basis for different product types provides lenders with a line of history that creates trust and eliminates signs of riskiness that could negatively impact your score.

If you can maintain a good credit score with monthly payments early on and over an extended period, you’re a shoo-in to reap the benefits.

2. Your Payment History

Your credit payment history is critical in depicting your credit score. For lines of credit, your overall payment history outlines:

Your ability to pay your balance in full and on time each month

Your history of debt (excluding mortgages)

Your ability to pay each debt, including

whether you paid the debt on time

whether payments were missing

whether the debt has been entirely paid off

whether any late charges were sent to collections

Any history of bankruptcy or claims against you

First and foremost, you are generally recommended to consistently pay off your monthly balances on time to avoid any score decreases. If you can do this, your score may remain high and stable as you’re demonstrating an excellent ability to manage and maintain the payment expectations of your lender.

When it comes to debts, bankruptcy cases, and claims, you may have a more challenging time upholding your score if you cannot meet the payment expectations of your lender. Best practices include keeping your debt history low, proper financial planning to avoid missing or late debt payments, and keeping your credit utilization low by avoiding any high-value purchases that may result in late payments.

3. Your Credit Utilization

Your credit utilization is a ratio that represents the amount of credit you use compared to your credit limit. For example, if your credit limit is $1000 and you use around $500 of your credit value every month, your credit utilization is 50%. The higher your credit utilization is, the more likely it is to negatively affect your score as it may exemplify that you’re using credit outside of your means. The last thing your lenders want is to see a credit utilization of 100% - that could indicate to them that you’re a risky credit user, which can impact your score.

A solid rule of thumb for maintaining a high credit score is to stay within 30% of your credit limit. So, if your credit limit is $1000 per month, you should aim to keep your payments around $300. At most, your credit utilization should consistently fall below 50%.

4. Your Credit Checks & Inquiries

There are two types of credit checks, but only one of them affects your credit score.

Soft checks occur for non-lending purposes, such as credit reports or credit score checks, and they do not affect your credit score. These checks stay in your credit report for up to 24 months.

Hard checks occur when a lender reviews your credit history if you apply for a loan or a credit card. Multiple hard checks within 14 days are treated as one inquiry which likely won’t affect your credit score, but too many hard checks beyond 14-day periods and within a short timeframe can send the wrong message to your lender. If you’re constantly requesting hard checks, you’re likely looking to engage with financial commitments (i.e. loans, investments, additional lines of credit) that could affect your overall financial portfolio and stability. Best practices include conducting all your hard-check ventures within 14 days to avoid further credit score penalties.

Increasing Your Credit Score

While we try to avoid it as best as possible, encountering point deductions throughout the lifespan of your credit history is expected. Deductions are sure to occur if you have a collection of late payments, a consistently high credit utilization ratio, or any loan-related issues.

Most positive information in your credit history will stay in your credit report forever, so the good stuff is here to stay. Alternatively, negative information can remain on your credit report for up to seven years, depending on the risks you’ve taken.

When it comes to securing a better credit score, you can do a few things to boost your points and recover a stronger on-paper relationship with your lender. With good behaviour, your credit score can improve in as little as six months, so stay positive as you move forward. Begin with taking a good look at your credit report to depict sites of riskiness. You can request a free copy of your credit report annually, online from Equifax or TransUnion. Once you have taken a good look and understand your history and errors, you can go ahead with a plan.

Here are a few tips that can carry your score forward.

1. Pay Your Bills, Reduce Your Credit Utilization, and Stay Away from Unnecessary Inquiries

Your top priority should be paying off your credit card bills on time month by month and consistently keeping your credit utilization within that 30%-50% range. These two things represent a responsible borrower and can increase your score with consistency and time.

Avoiding unnecessary hard checks can also keep your score at bay by averting any signs of risky behaviour.

2. Debt Planning

Whether you set up a payment plan with your lender or create an independent plan on your own – when it comes to paying off debts, you need to proceed with caution and have a plan in motion to ensure you have the funds to cover your debts, and you’re able to make payments on time. Sit down with a financial advisor to review the best actions and the easiest way for you to pay your debts without affecting your overall economic lifestyle.

In multiple-debt situations, focused on delinquent and high-interest accounts before proceeding with lower-level debts. Moreover, consider a debt consolidation loan or transfer the balance to a lower-rate credit card. If refinancing your property is an option, you may benefit from using your equity to pay off debts while “transferring” that balance into your mortgage, to be paid off over a longer period with a lower interest rate. The possibilities are endless - your action plan is up to you and your capabilities.

3. Avoid Closes

Once you’ve paid off a line of credit that may have been dragging your score down, you may feel inclined to close the account. While this may seem like a good idea, it could further affect your credit score by limiting your credit history and shifting your utilization ratio.

Your credit utilization ratio is calculated with the value of your entire line of credit versus your used credit. To put things in perspective, say you have $1000 on one card and $1000 on another. Your total credit value is $2000. If you were to spend $500 on one card, you would use $500 out of your $2000 line of credit. Therefore, your credit utilization for that month would be 25% rather than 50%, thus keeping it low.

Keeping a line open can help you improve your credit score and prove your creditworthiness across more than one line.

My final best practice is to view your credit score kind of like a Social Insurance Number. It’s not as long of a number as your SIN, but it is a three-digit value that follows you throughout your life and wealth development journey. It influences and represents your financial standing the same way your SIN represents your identity. So your credit score is almost like a part of your financial identity.

Both these numbers stay with you for life, and in many cases, both are required for big lifestyle and financial decisions. Keeping your credit score in good health will always boost you, especially if you have big money plans!

Interested in learning more about credit scores or have any questions? Feel free to reach out to me on Instagram or click the link below to send me an email!